2025 Tax Brackets Head Of Household

2025 Tax Brackets Head Of Household. There are seven (7) tax rates in 2025. The 2025 tax brackets apply to income.

You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. The basic exemption limit of rs 3 lakh in the new tax regime is still very low and there is a widespread expectation.

2025 Tax Brackets Head Of Household Erica Blancha, The basic exemption limit of rs 3 lakh in the new tax regime is still very low and there is a widespread expectation. 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower than the 7.1%.

2025 Tax Brackets Head Of Household Danila Delphine, Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate. However, most agree that the 30% tax slab above an income.

Tax Calculator 2025 2025 Alexa Harriot, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. You pay tax as a percentage of your income in layers called tax brackets.

Tax Free Day 2025 Eligibility Chart Gray Phylys, The basic exemption limit of rs 3 lakh in the new tax regime is still very low and there is a widespread expectation. The minimum tax rate is for those who are earning less than $11,000 annually.

Tax Brackets 2025 2025 Nelia Wrennie, Replacing the 10% and 12% brackets with a 15% rate could raise the tax burden on those making less than $47,150 a year. These brackets apply to federal income tax returns you would normally file in early 2025.) it's also.

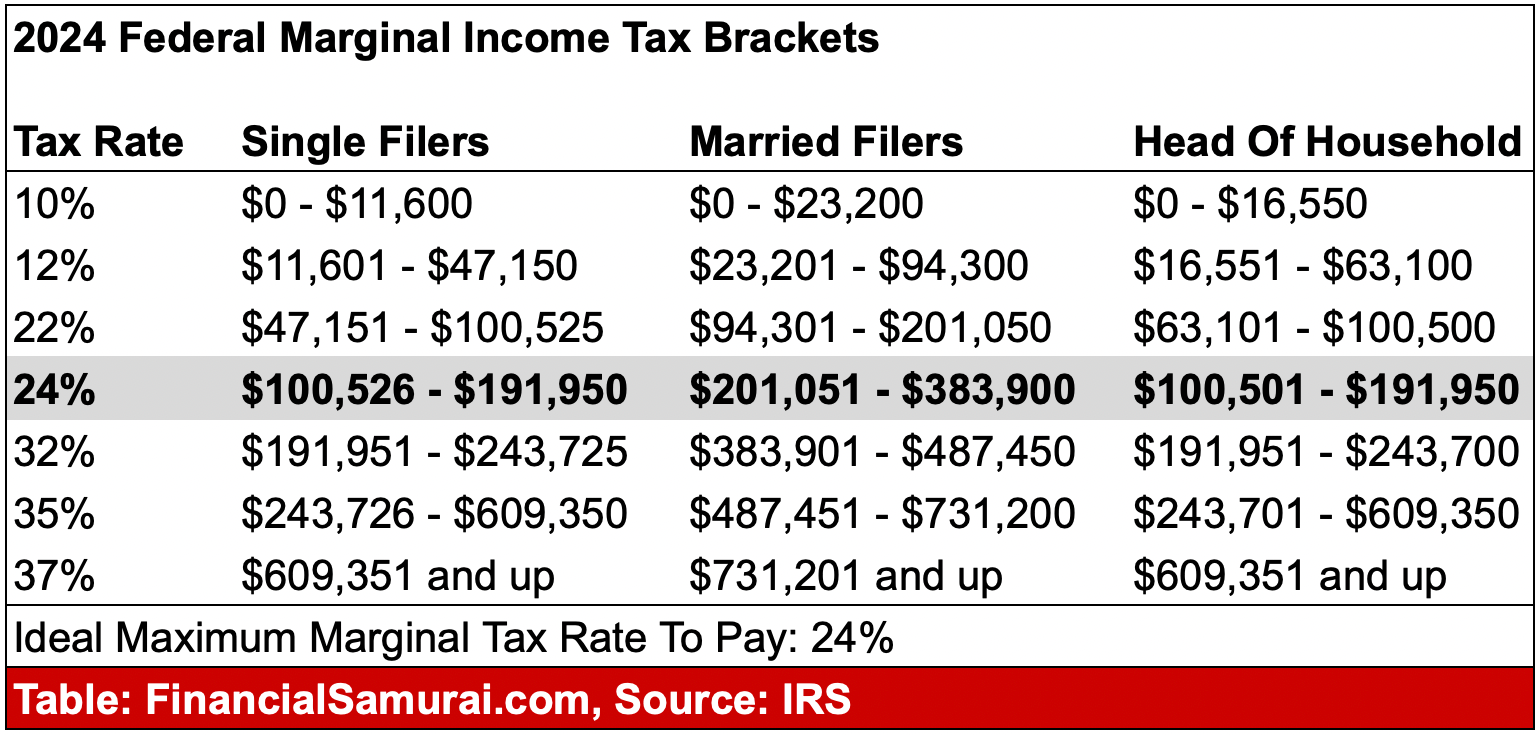

Irs Standard Deduction 2025 Head Of Household Sonia Eleonora, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Tax Brackets Single Head Of Household Kare Kessiah, These brackets apply to federal income tax returns you would normally file in early 2025.) it's also. Ever wonder what the difference is between a single filer and a head of household filer?

Tax Bracket 2025 Jamima Selina, You pay tax as a percentage of your income in layers called tax brackets. These brackets apply to federal income tax returns you would normally file in early 2025.) it's also.

Tax Brackets 2025 For Head Of Household Tabby Shayna, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. See current federal tax brackets and rates based on your income and filing status.

2025 Tax Brackets And The New Ideal Money Wiseup, The tax brackets are wider for people who file as head of household. As your income goes up, the tax rate on the next layer of income is higher.