Ira Cap 2025

Ira Cap 2025. The maximum contribution limit for roth and traditional iras for 2025 is: For 2025, single and head of household filers with a magi below $146,000 (up from $138,000 last year) can contribute the full $7,000 in 2025.

Follow all the action from ipl 2025, including the ipl 2025 schedule and ipl 2025 points table. You can contribute to an ira until the tax deadline for the previous.

The first rmd now is required by april 1 of the year after turning age 73 for anyone who turns 72 after.

IRA Contribution Limits in 2025 Meld Financial, The rajasthan royals face the delhi capitals in an ipl 2025 match, led by skipper rishabh pant. In fact, the energy, materials, industrials, utilities, and financial sectors are all beating the.

Unlock Your Financial Future A Quick Guide to 2025's IRA and, With the passage of secure 2.0 act, effective 1/1/2025 you may also be eligible to. The maximum contribution limit for roth and traditional iras for 2025 is:

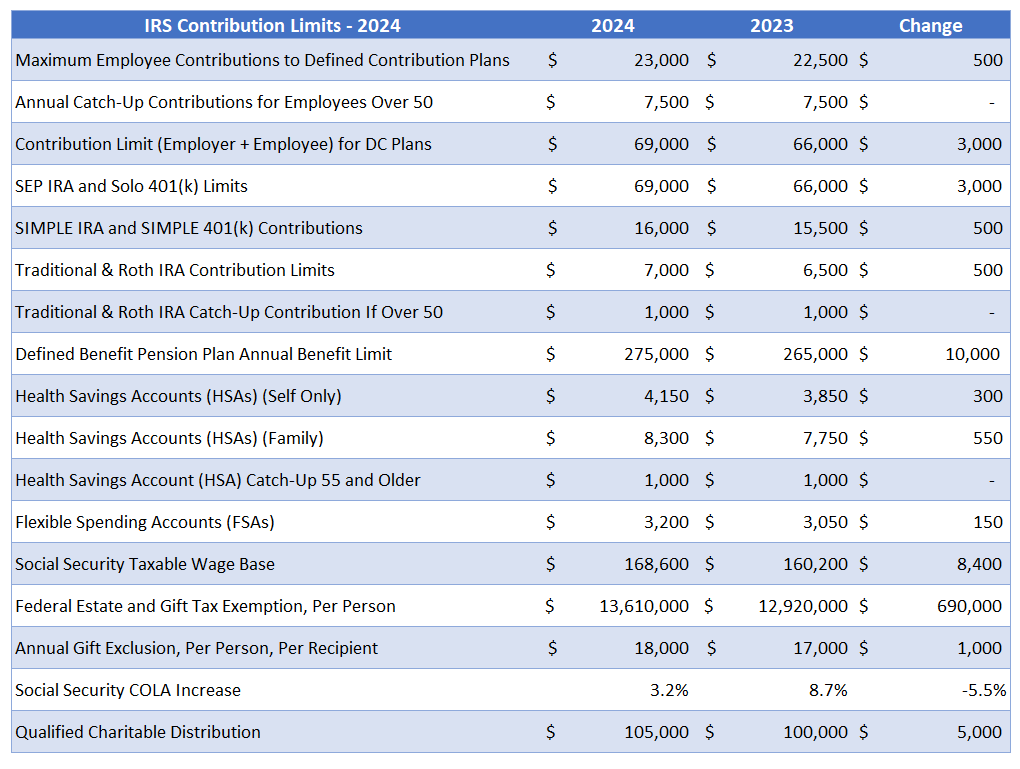

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Take rmds from your traditional iras. For 2025, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older.

2025 Ira Contribution Limits Over 50 EE2022, On march 29, kohli struck an undefeated 83. This is your deductible ira contribution limit for 2025.

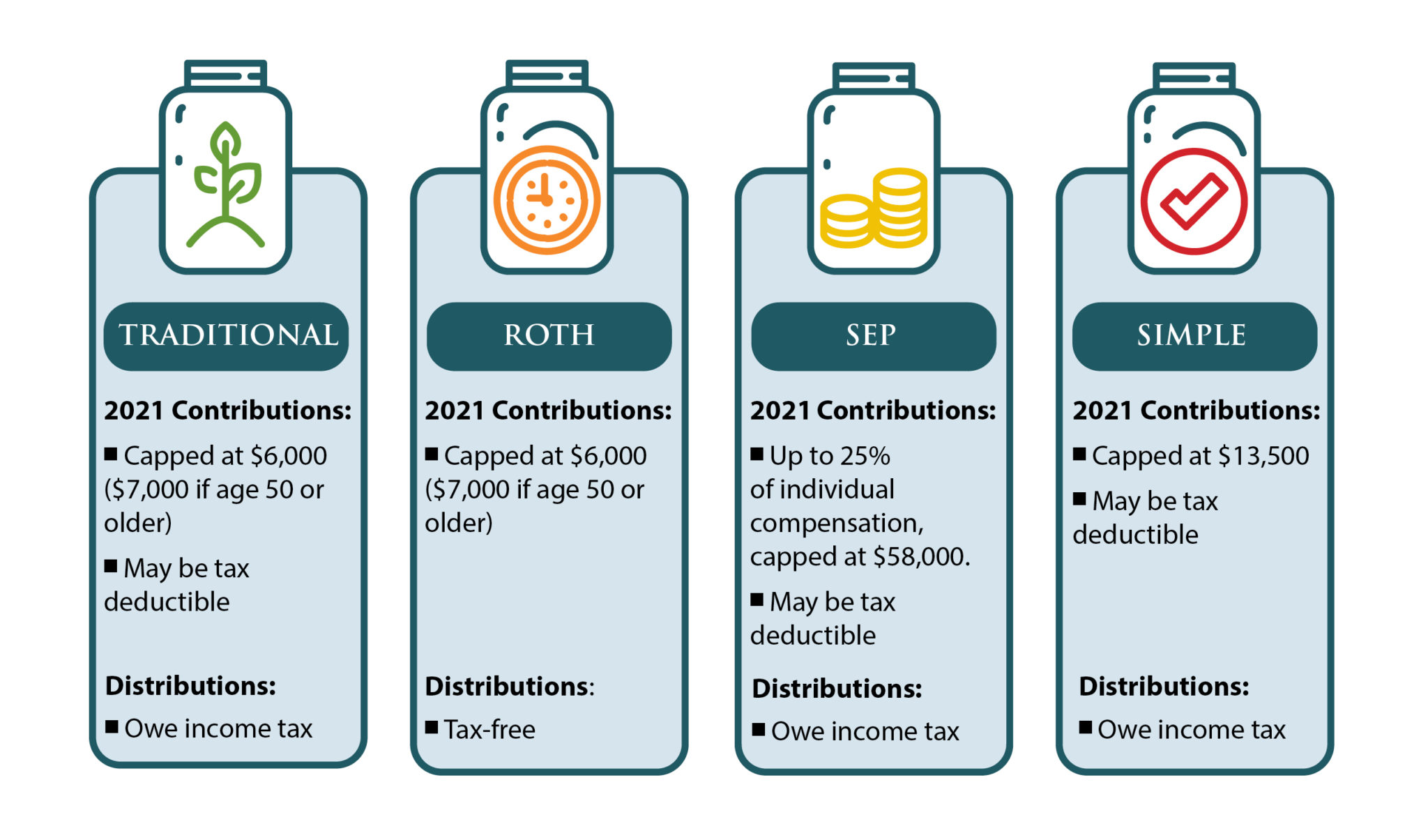

IRA account types infographic Preferred Trust Company, The inflation reduction act (ira) brings several changes to medicare part d for the year 2025. In fact, the energy, materials, industrials, utilities, and financial sectors are all beating the.

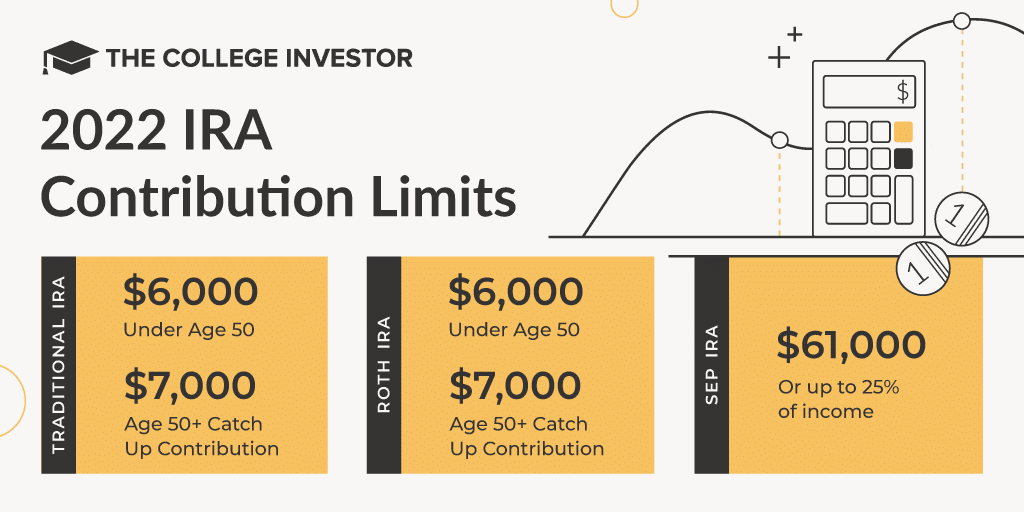

IRA Contribution Limits And Limits For 2025 And 2025, To contribute to a roth ira, single tax filers. In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.

The Homeowner’s Guide to IRA Tax Credits and… Pearl Certification, For 2025, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. But that doesn't mean tech is the only sector winning in 2025.

Adam Talks The Roth IRA Cap is Coming YouTube, To contribute to a roth ira, single tax filers. This is an increase from 2025, when the limits were $6,500.

2025 IRS Contribution Limits For IRAs, 401(k)s, and More, You can make 2025 ira contributions until the unextended federal tax deadline (for income. $7,000 (or $8,000 if you are over age 50 and.

SIMPLE IRA Rules, Providers, Contribution Deadlines & Limits Small, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year is $6,500 and $7,500 if you're. Here are the income limits, eligibility requirements, tax treatment and withdrawal rules for traditional iras.